Julian Opuni, Managing Director of Fidelity Bank, has recognized and applauded the Ghana Card’s noteworthy contributions to the financial industry.

Following his meeting with the Oxford Business Group, Julian Opuni, the MD of Fidelity Bank, gave a statement in which he highlighted the significant progress the Ghana Card has achieved in enhancing security protocols and thwarting financial sector fraud.

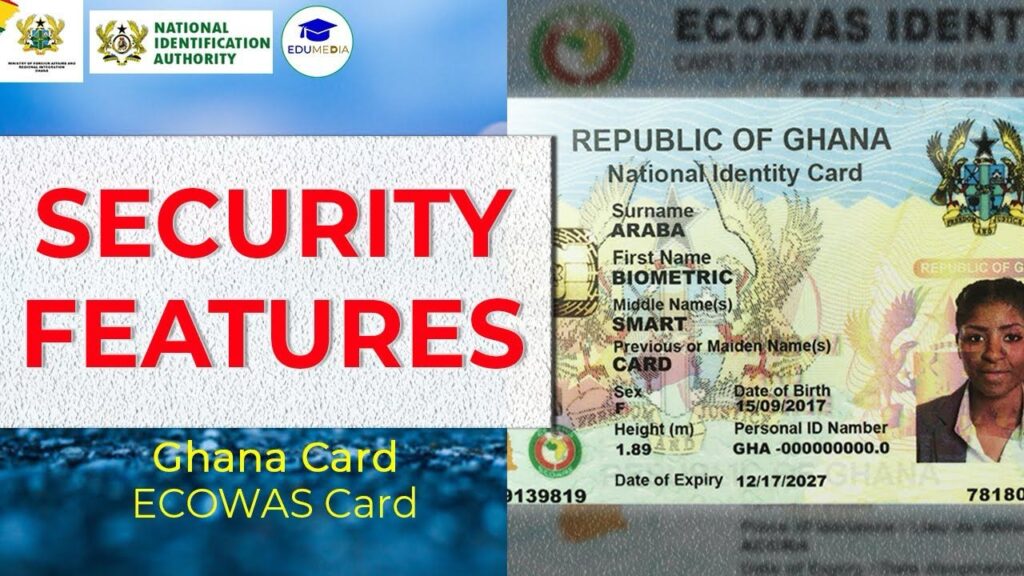

He praised the Ghana Card’s contribution to cleaning up the financial industry, but he also emphasized the card’s robust biometric capabilities, readability of real-time data, and easy integration with other systems. He also mentioned the card’s role in supporting accurate Know Your Customer (KYC) compliance and anti-money laundering initiatives.

He also discussed how the Ghana Card has changed the risk profile of government securities, which could eventually make banks more interested in financing from the private sector.

Additionally, Mr. Julian Opuni mentioned the critical role the Ghana Card has played in enabling digital transactions, particularly the interoperability of mobile banking and mobile money, which he said is moving the nation closer to a cashless society.

“By utilizing the extensive database, both fintech and traditional banking institutions may provide a range of financial services and encourage cashless transactions. Because of these developments, entry barriers are reduced, especially for those from low-income backgrounds, and the financial ecosystem becomes more inclusive. In an interview with the Oxford Business Group, Opuni stated, “The Ghana Card provides accessible formal identification, especially for those in remote areas, by streamlining the online and in-person account opening process.”